On 26 May 2016, CIRS successfully held the free webinar on the topic of ‘How to Place Oral Care Products in China Market from the Regulatory Point of View’. In the webinar, the Chinese oral care product market was analyzed, and the management of oral care products in China and other countries was covered. At the end of the webinar, the future trend of oral care product management in China was discussed. The webinar can be briefly summarized as following:

Chinese Oral Product Market

1. Sales data in 2015

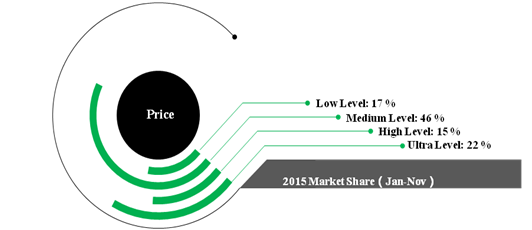

In 2015 (Jan-Nov), the total revenue of 46 largest toothpaste manufactures is up to 16.8 Billion RMB with 7.6% growth rate. Figure 1 shows the market share for toothpaste with different price. The market share of the toothpaste in ultra level is higher than the toothpaste in low level.It indicates the trend that consumers would spend more money on oral care.

Figure 1 Toothpastes’ market share in terms of different level of price

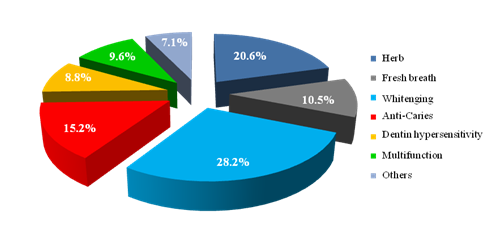

Figure 2 shows the market share of functional toothpaste. Whitening and herb toothpaste take up half of the market, followed by anti-caries, fresh breath, multifunction, Dentin hypersensitivity and others.

Figure 2Market share of functional toothpaste

2. Brand Competition

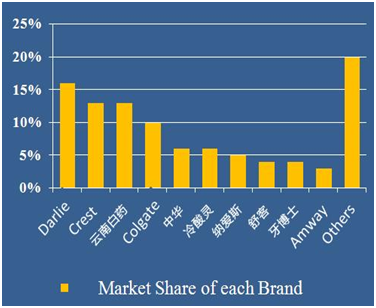

The retail sales of toothpaste in 2014 are 45 Billion. Foreign brands take 55% market share while local brands count 45%. In Figure 3, among Top 10 brand, there are 5 foreign brands. They are Darlie, Crest, Colgate, Unilever, and Amway.So far, 9 foreign brands have set branches in China. There are around 85 toothpaste enterprises in China while only 10 company have annual sales more than 100 million tubes.

Figure 3 Market share of each brand

3. Sales Channel Analysis

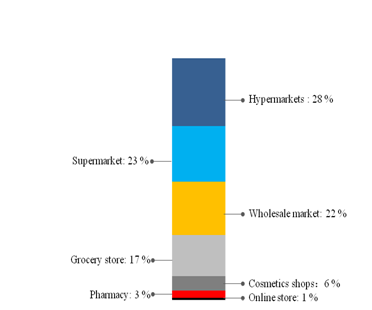

Figure 4 shows the market share of different sale channels. Hypermarket and supermarket occupied more than half of the market. Online shopping for toothpaste is not popular in 2014.

Figure 4 Distribution of sales channels in 2014

Management of Oral Products in Other Countries

1. ISO standardsfor Toothpaste & Mouthwash

ISO 11609-2010 is applied to toothpaste. And ISO 16408-2015 is applied to mouth wash. The standard includes scope, definition, property, test method, labeling, and package requirement, etc. For example, the property standard claims that the fluoride content in toothpaste should be less than 0.15% and its pH should be lower than 10.5.

As is shown in Table 1, the labeling standard consists of following items for toothpaste and mouth wash.

Table 1 ISO Label Standard for Toothpaste & Mouthwash

Toothpaste:ISO 11609-2010 | Mouthwash:ISO 16408-2015 |

1. Product name (including brand name) | 1. Product name (including brand name) |

2. Information of manufacturer and distributor | 2. Information of manufacturer and distributor |

3. Production information | 3. Production information |

4. Ingredients (INCI) | 4. Ingredients (INCI) |

5. Name and content of fluoride | 5. Name and content of fluoride and alcohol |

6. Expiration date (within 30 months) | 6. Expiration date (within 30 months) |

7. Net Content | 7. Net Content |

8. Attention (instruction for kids under 6 and fluoride content is higher than 1000μg/g) | 8. Attention (instruction for kids) |

9. Others: Not for kids under 6; No swallowing; read instruction and dilute before application; read instruction and mix before application |

2. Standards in US, EU and Japan

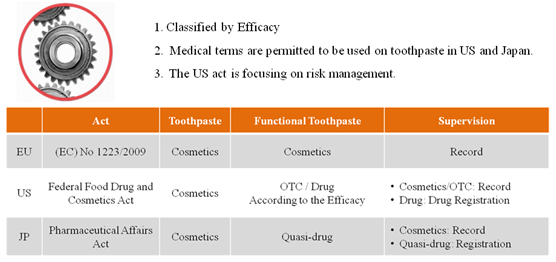

US act focus on the risk management. The functional toothpaste with efficacy included in OTC monograph will be managed by OTC system. Both cosmetics and OTC will take the record keeping by the companies themselves. However, the toothpaste with efficacy excluded in OTC Monograph should be registered as new drug. All kinds of toothpaste are considered as cosmetics in EU and should have record-keeping with European Community. Toothpastes are considered as cosmetics in Japan as well. But functional toothpaste is regarded as quasi-drug. Figure 5 presents the management system of toothpaste in EU, US and Japan.

Figure 5 Management system in EU, US and Japan

Chinese Oral Products Standards and Trends

1. Classification of Oral Care Products

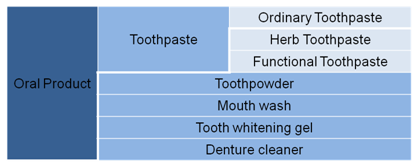

According to draft Regulations Concerning Supervision and Administration of Cosmetics 2014, Cosmetics are defined as the products which can be spread on the outer surface of human body (e.g. skin, hairs, nails. lips etc), theteeth and oral mucosafor the purpose of cleaning, protecting, beautifying, deodorizing and keeping in good condition, by way of smearing, spraying or other similar means. Figure 6 shows the detailed classification of oral care products.

Figure 6 Classification of Oral Products

2. Current Regulations and Standards

Currently, there are three main regulations in effect:

- Hygienic Standard for Cosmetics – HSC 2007

- Technical Safety Standard for Cosmetics – TSSC 2015 (Come into force on 1stDec 2016)

- Inventory of Existing Cosmetic Ingredients in China – IECIC 2015

There are 10 standards for toothpaste product, 16 standards for toothpaste ingredient, 21 standards for inspection, 2 general standards and 1 labeling standard.

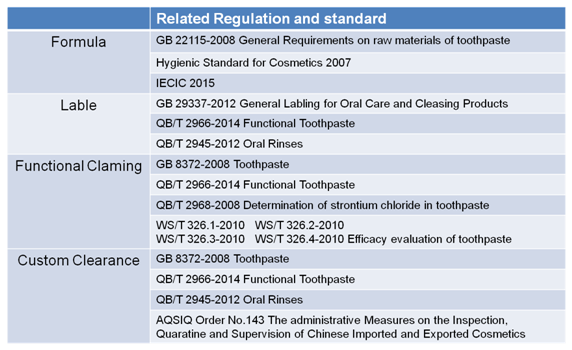

The regulatory compliance process can be divided in to four main sections: formula review, labeling review, functional claiming examination and custom clearance. Figure 7 illustrates the regulations and standards related in four sections.

Figure 7 Related Regulations and Standards

3. Efficacy Evaluation

Two cases were studied to emphasis the importance of efficacy verification.

Case 1: Crest claims its efficacy of whitening tooth within 1 day on TV. The exaggerate efficacy claim is achieved by photoshop. In this way, Crest was fined 6 million yuan by Industrial and Commercial Bureau in 2015 for inappropriate advertising.

Case 2: SENSODYNE cannot provide proof for its multiple function claims on the package and was fined 40,000 yuan in 2015 for inappropriate claim.

According to QB/T 2966-2014 Functional Toothpaste, efficacy verificationtest must be taken by CFDA certified hospital or dental labs. Safety evaluation of functional ingredient should follow GB 22115-2008. Qualitative or quantitative test of functional component should be performed by the internal lab of enterprise or third-party lab.

4. Future Trends

Currently, oral products can free enter Chinese market without record or registration. Efficacy verification standards are published for functional toothpastes. However, there are no stands for the management of herb toothpaste, children products and mouthwash in China.

The assumptions of oral care product management in the future are made as:

- The toothpaste might be managed as cosmetics in the future. The oral care products should obtain CFDA license for pre-market approval.

- The OTC system might be adopted. Ordinary toothpaste might be managed as cosmetics. Functional toothpaste would be managed as OTC or drug.

Free Download:

https://freedoc.cirs-group.com/en/downloads/cosmetics/How_to_Place_Oral_Care_Products_in_China.html